What Will Dutch Bros Stock Be In Five Years?

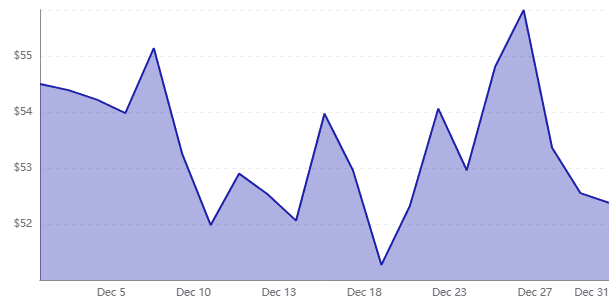

Dutch Bros (BROS -0.32%) is a small coffee shop operator with its eyes on the prize. It has expanded from a regional company to a company with outlets in 18 states and the reaction to the product varies across these states which is encouraging. While the company has expanded across the nation, its stock has been volatile, but it is 68% higher in 2024 and trouncing the market. Where might it be five years from now?

What has been done in the last five years

Dutch Bros came to the public market in 2021 but has been in existence for a much longer time. The company began its operations in 1992 as a push cart in Oregon.

When the company grew into having multiple outlets, the company maintained the culture of fun and music of Dutch Bros. It’s maintained that a part of its brand as it moves into becoming a large chain, bringing good vibes for each store with a relaxed and customer-oriented environment.

It had 503 stores when it went public, largely in the Western United States, and had 950 by the end of September 2024, or nearly double in three years. It opened approximately 150 outlets in 2024 and has aspirations of owning approximately 4,000 outlets in the next 10 to 15 years, which means more outlets need to be opened.

The company has been able to record high revenues after IPO especially in the third quarter where its revenues grew by 28% year over year. Similarly, it has had less reliable same shop sales growth. This has been influenced by a number of factors in the last few years in particularly a challenging operating environment.

Dutch Bros. was able to increase its prices to match the inflation rate and is still surviving a reduction in consumer spending. This has been better and worse over this time and was 2.7% in the third quarter for same-shop sales growth. The quarter also had its best transaction growth in two years, an indication that its same-shop growth is not only from the inflation of prices.

The company has also evolved from a sometimes profitable company to a fully profitable one although the period of record is rather short here. It made a first full-year profit in 2023 and is expected to make one for 2024 also. Net income was $21.7 million in the third quarter and $13.4 million in 2023.

What the future will be in the next five years

Investors were concerned when management stated earlier this year that it expected to be at the lower end of its store opening guidance for 2024. It is important to note that while Dutch Bros. is growing it had to alter some of the real estate strategy, and certain targeted areas simply did not fit the new mold.

This could feel like a blow and is definitely not something that should be turned the other way. However, if the company can locate more areas to open more outlets more strategically and with fewer costs, then shareholders will be better off. Management has not given a 2025 forecast but if its new strategies are on track, then there should be higher growth plans for the new year if the company still intends to achieve its long-term store targets.

In other words, as Dutch Bros keeps on establishing new stores in new areas, it should not be very hard for it to grow its revenues. The more telling figure is the growth in same-store sales. The company has handled itself reasonably well under pressure from the economic environment, and should start reporting same-store sales growth soon.

Mobile ordering has just been launched across all the stores of Dutch Bros. It should help it to increase its top and bottom lines as it opens new stores with mobile ordering already incorporated. Some of the newer stores that the company is constructing are designed to accommodate in-store, mobile, and walk-in ordering windows.

Everything in operations should translate to an upward trend in the company’s bottom line. It has guided for $0.45 per share in 2024 from $0.30 in the last year, and for $0.55 in 2025.

Dutch Bros is well organized and on its way to the efficient model it should be five years from now. Any money deposited today by investors should be expected to grow at what could be a market-beating rate.