Could Buying Dutch Bros Stock Today Set You Up for Life?

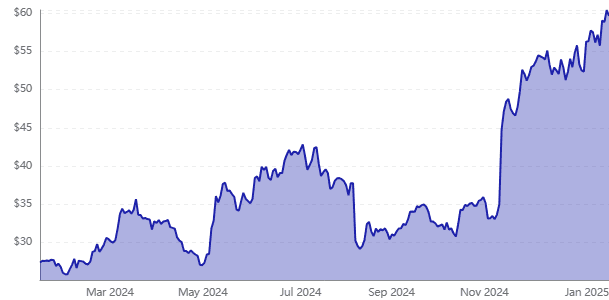

Dutch Bros (BROS -1.27%) share prices have been soaring, increasing by well over 100% over the past year. Nevertheless, the stock is still below the level that is typical after the so-called IPO pop that often accompanies new offerings. Because this coffee shop has grown to the extent that has been illustrated, one would naturally assume that there is more potential in the future. If the growth persists, it could help set investors up for life, but there is one critical figure they should pay attention to if they invest in it.

Dutch Bros is a fast-growing coffee chain.

The stock has more than doubled over the past year or so but is still below its post-IPO high.

Dutch Bros may be a very promising investment in the long run, but there is one number that investors should be especially careful about.

Dutch Bros business is expanding rapidly

The traditional method for a small restaurant brand to expand is to open many new outlets. That is the macro-strategy that Dutch Bros and the coffee shops have to tell. For instance, in the third quarter of 2024, it opened 38 new outlets of which 33 were company operated and the remaining opened by franchisees (as will be explained later). Those new openings took the company’s store to 950, including 645 stores that were operated directly by the company.

Currently, Dutch Bros has 794 outlets, which means it expanded its outlets by approximately 20% in the last one year, and this was as of the end of the third quarter of 2023. That is a significant amount of store expansion. And so it should not come as a surprise that the company’s sales rose by a rather impressive 28% year on year. This is why investors are so excited.

But what was the potential of Dutch Bros; How large could it become? Starbucks (SBUX 0.74%) had more than 40 000 stores at the end of September 2024. Since Dutch Bros is not even at 1000 stores yet, even if it grows to be a quarter of Starbucks, there is so much room for the company to grow and so, if the stock also grows along with the company, growing this could potentially be life changing.

The number to watch at Dutch Bros

Before you get too excited, there is something called same-store sales which measures sales from stores that have been around for a while. New locations can significantly boost sales this is why the focus is on growth locations while same store sales inform you how specific stores, those the company already owns are performing. All too frequently, Wall Street encourages young restaurants to grow as rapidly as they can, which causes management to get fixated on openings at the expense of the outlets they already have. If same store sales are low, then the brand cannot be very strong even though the overall sales figure may be on an upward trend.

For the period, the company’s same-store sales increased by 2.7% in the third quarter. That’s OK, but not great. In the same respect, Cava (CAVA 0.61%), a small Mediterranean-themed restaurant brand, recorded an increase in same-store sales by 18.1%. That’s probably not sustainable but it does indicate there is a lot more demand for the Cava concept than there is for the Dutch Bros’ concept. But single-digit same-store sales growth is not so bad as long as the company is opening more outlets at a fast pace.

Before you get too excited, there is something called same-store sales which measures sales from stores that have been around for a while. New locations can significantly boost sales this is why the focus is on growth locations while same store sales inform you how specific stores, those the company already owns are performing. All too frequently, Wall Street encourages young restaurants to grow as rapidly as they can, which causes management to get fixated on openings at the expense of the outlets they already have. If same store sales are low, then the brand cannot be very strong even though the overall sales figure may be on an upward trend.

For the period, the company’s same-store sales increased by 2.7% in the third quarter. That’s OK, but not great. In the same respect, Cava (CAVA 0.61%), a small Mediterranean-themed restaurant brand, recorded an increase in same-store sales by 18.1%. That’s probably not sustainable but it does indicate there is a lot more demand for the Cava concept than there is for the Dutch Bros’ concept. But single-digit same-store sales growth is not so bad as long as the company is opening more outlets at a fast pace.

There’s a big opportunity with Dutch Bros

Before you get too excited, there is something called same-store sales which measures sales from stores that have been around for a while. New locations can significantly boost sales this is why the focus is on growth locations while same store sales inform you how specific stores, those the company already owns are performing. All too frequently, Wall Street encourages young restaurants to grow as rapidly as they can, which causes management to get fixated on openings at the expense of the outlets they already have. If same store sales are low, then the brand cannot be very strong even though the overall sales figure may be on an upward trend.

For the period, the company’s same-store sales increased by 2.7% in the third quarter. That’s OK, but not great. In the same respect, Cava (CAVA 0.61%), a small Mediterranean-themed restaurant brand, recorded an increase in same-store sales by 18.1%. That’s probably not sustainable but it does indicate there is a lot more demand for the Cava concept than there is for the Dutch Bros’ concept. But single-digit same-store sales growth is not so bad as long as the company is opening more outlets at a fast pace.