Dutch Bros Stock Growth Story & Justify the Price Tag?

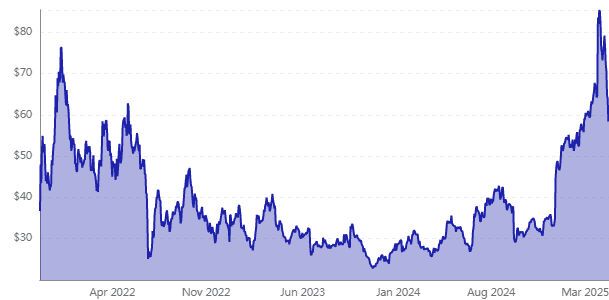

Over the past year, Dutch Bros’ (BROS 3.01%) stock price has more than doubled. It’s perhaps not surprising given the coffee chain’s growth. The problem here is small, but investors have to consider it: Is Dutch Bros growing fast enough to support its price?

What are investors paying for Dutch Bros?

Most of these are standard value metrics that investors use as a proxy of how attractive a stock is: price to sales (P/S), price to earnings (P/E), price to book value (P/B). Currently, Dutch Bros’ P/S ratio is 5.2, P/E is 190 and P/B is nearly 14. Without some comparison points, these numbers will say very little. Assessing valuation in one of the common ways is to compare a stock’s current valuation multiples to its historical trends in the same metrics.

This will show you how views have changed over time and help you identify if today’s view is that shares are relatively cheap or not.

It’s only been public for a couple of years and that’s not a useful option for Dutch Bros. In fact, there is not enough data available to calculate a three year average for any of these metrics yet.

That leaves two other options. The ratios can be compared to competitors and to the broader market on an absolute basis.

As for competitors, the most obvious direct choice is Starbucks (NASDAQ: SBUX). This coffee chain with this iconic brand is trading at P/S of 3.5, P/E of 33 and P/B which is not meaningful as its book value is negative. However, the first two valuation metrics clearly show that Dutch Bros is quite expensive compared to Starbucks.

What has Dutch Bros been doing?

When thinking of Dutch Bros as a restaurant chain, it has to be considered a restaurant chain growing quickly, with a lofty valuation in the process. It managed to grow its top line by an enormous 32.6% in 2024. Opening 151 new locations was largely the cause for that. Sure, management hasn’t overextended the concept because same store sales rose a respectable 5.3% for the year.

That’s true, transactions were down 0.1%, which means that the main driver of the same store sales gain wasn’t more customers, it was price increases. Although not good, a 0.1 percent traffic decline is not a terrible result.

Dutch Bros looks to open at least 160 new locations and have same store sales growth of 2% to 4% in 2025. The revenue is projected to be between $1.555 billion and $1.575 billion, which is a growth of 21 percent to 23 percent. That is strong growth no doubt, but not quite as strong as the growth in 2024. It’s no surprise that Dutch Bros’ growth rate is expected to be lower as it grows. However, the valuation is so high that a dip in growth here could result in a reevaluation of the stock on Wall Street. Alternatively, the stock could tumble if investors are not happy with Dutch Bros’ growth, which is interesting because the stock has dropped about 30% since the company reported full year 2024 earnings in February.

Dutch Bros is cheaper than it was, but still expensive

Dutch Bros is a small and fast growing restaurant chain. It has had a meteoric rise in its stock price, which makes it overvalued compared with both a large competitor and the broader market. Even after a sharp decline in the stock, that remains true.

This is not a good choice for risk averse investors or anyone who has a value bias. So even the growth investors should probably take caution. To justify today’s price tag on the stock, you have to believe strongly that Dutch Bros is going to execute at a high level.

Should you invest $1,000 in Dutch Bros right now?

Investors should analyze these points before acquiring Dutch Bros stock.

According to the Motley Fool Stock Advisor analysts their current list of recommended stock purchases does not include Dutch Bros. The selected ten stocks have the potential to deliver extraordinary market returns during the next few years.

The investment of $1000 on the December 17, 2004 Netflix recommendation would have grown to $467,393.

The Stock Advisor team identified Nvidia in their April 15, 2005 recommendation which would have turned a $1,000 investment into $655,630.

The total average return from Stock Advisor surpasses the S&P 500 by a significant margin of 789% compared to 163%. Stock Advisor members can access the current top 10 list right after joining the service.