Could Buying Dutch Bros Stock Today Set You Up for Life?

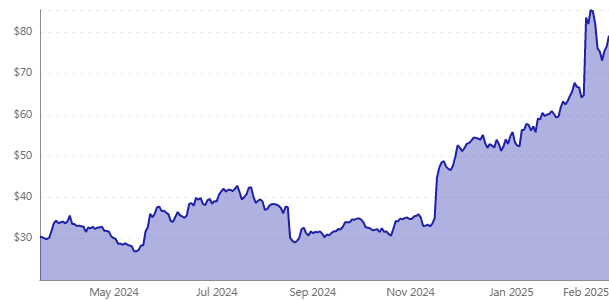

Dutch Bros (BROS 3.40%) is a coffee company investors with a taste for a good cup of joe should pay attention to. The shares of the drive-through coffee shop operator and franchiser are piping hot, up 160 percent over the past year. The company has been very innovative, with its drive through beverage concept being very popular, with high growth and strong profitability.

The stock is trading at a premium price, but there are still plenty of reasons to think that it is still in the early innings of a much bigger opportunity. For the company’s shareholders, a national expansion would prove highly lucrative if the company can execute. Is buying Dutch Bros stock today a recipe for multibagger returns that would set its investors up for life? Here’s what you need to know.

Strong demand at Dutch Bros’ drive-through coffee shops has propelled the coffee chain to exceptional growth.

On an ongoing national expansion strategy, the company plans to accelerate the pace of new openings.

Although the stock is pricey, it is well supported by a bright long term outlook.

We posted 10 stocks we like better than Dutch Bros

Strong growth momentum

Dutch Bros has grown into one of the fastest growing food and beverage brands in the U.S. with 982 shops at the end of 2024, more than double the company’s 471 shops at its 2021 initial public offering (IPO).

One major theme in 2024 was the rapid opening of shops, and the company is looking to open at least another 160 new stores in 2025. Such spectacular financial trends necessarily imply highly profitable unit economics, which makes this expansion strategy a no brainer.

For 2024, Dutch Bros’ revenues increased 33 percent year over year to $1.3 billion and adjusted EPS rose 63 percent from 2023 to $0.49 per share from $0.30. The 6.8% growth in company operated same shop sales, is even more impressive and this is the case as it has picked up steam in recent quarters, bolstering both transactions and higher prices. The brand momentum indicator shows a fervent brand momentum that will help to create a further growth runway.

Catalysts in 2025 and beyond

For 2024, Dutch Bros’ revenues increased 33 percent year over year to $1.3 billion and adjusted EPS rose 63 percent from 2023 to $0.49 per share from $0.30. The 6.8% growth in company operated same shop sales, is even more impressive and this is the case as it has picked up steam in recent quarters, bolstering both transactions and higher prices.

The brand momentum indicator shows a fervent brand momentum that will help to create a further growth runway. There will be a number of developments that investors can look forward to that will be multiyear transaction drivers. The company is ramping up mobile ordering availability through its app first. Not only does the system keep users engaged with a loyalty program, it also helps the operation’s efficiency by reducing the wait time. Dutch Bros is also testing an expanded food menu.

However, how Dutch Bros stock performs over the next 10 years will depend on the success of these initiatives.

| METRIC | 2024 | 2025 ESTIMATE |

|---|---|---|

| Revenue | $1.3 billion | $1.6 billion |

| Revenue Growth (YOY) | 32.6% | 23.2% |

| EPS | $0.49 | $0.59 |

| EPS Growth (YOY) | 63.3% | 20% |

DATA SOURCE: YAHOO! FINANCE. YOY = YEAR OVER YEAR.

Reasons to hold off on the caffeine

Before going all in on one of Dutch Bros’ signature flavored iced lattes and stocking up on the stock, it makes sense to take a critical look at it and wonder what could possibly go wrong.

The idea of opening more than 4,000 shops in the next 10 to 15 years means that Dutch Bros will need to speed up the number of new shop openings each year. As it begins to develop quickly, some logistical headwinds start to come into play, especially finding prime real estate locations that fit within the drive through model and operating those locations on a scale.

The main risk to consider by this measure is a scenario where growth starts to disappoint relative to these lofty expectations. However, seen in the context of a background where Dutch Bros already sports a rich valuation, as evidenced by the current stock trading with a premium 127 times the consensus EPS estimate for 2025, more than just growth well into the future is baked into the front end.

This metric on its own does not necessarily imply that the shares are too expensive to own or that they should be sold off, but it at least could be a way to limit the near term upside in the stock price.

The big picture for investors

Ultimately, Dutch Bros will determine whether it delivers life changing returns over the next decade as it continues to capture market share and Starbucks maintains its leadership role in the quick serve beverage category. Dutch Bros’ latest results are encouraging, but that possibility is still on track while there is a long road ahead. However, don’t forget that banking only on one stock is not a good way to make money. And investors should also have a diversified portfolio and never expect to make a lot of money from just one stock.

But investors who believe the Dutch Bros concept and its long-term potential have a tasty addition to their diversified portfolio in the stock now.

Should you invest $1,000 in Dutch Bros right now?

Ultimately, Dutch Bros will determine whether it delivers life changing returns over the next decade as it continues to capture market share and Starbucks maintains its leadership role in the quick serve beverage category. Dutch Bros’ latest results are encouraging, but that possibility is still on track while there is a long road ahead. However, don’t forget that banking only on one stock is not a good way to make money. And investors should also have a diversified portfolio and never expect to make a lot of money from just one stock.

But investors who believe the Dutch Bros concept and its long-term potential have a tasty addition to their diversified portfolio in the stock now.